FOR KEY TAX FORMS

Many Buyers Will Have to Make Costly Upgrades

(Boston) — Regular purchasers of Intuit’s TurboTax Deluxe, the top selling desktop tax preparation software program, are in for a nasty surprise this year. The company has stripped the program of key functionality to easily report income from investments, self-employment, and rents, thereby requiring affected users to upgrade to more expensive versions.

“What a clever ploy. Yank out key parts of the program that people have used for years, and then charge them more money to get back the missing pieces,” commented ConsumerWorld.org founder Edgar Dworsky. “Imagine the reaction of perhaps millions of regular TurboTax users who may learn partway through doing their taxes that they have to pay an upgrade fee just to get the same functionality they’ve always enjoyed. They are not going to be happy.”

The full interview sections (Q&As) for filling out Schedule C (self-employment income and all expenses), Schedule D (investments), and Schedule E (rental and partnership income) are no longer in TurboTax Deluxe ($59.99 list). The complete Q&A Schedule D (with importation of brokerage data) and Schedule E are now only available in their “Premier” and higher editions ($89.99), and the full Schedule C is only available in their “Home & Business” version ($99.99). In-program upgrades from TurboTax Deluxe will cost users an additional $30 to $40, as the warning below indicates, when, for example, trying to enter investments.

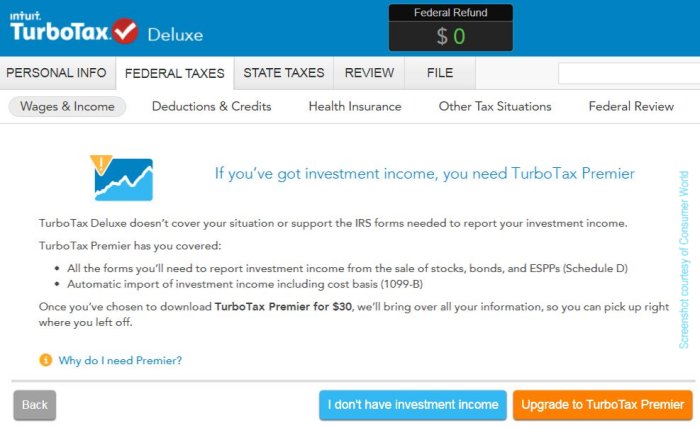

*MOUSE PRINT:

Upgrade notice and roadblock in program when users try to enter investment income

Consumers are already voicing complaints. The product has gotten hundreds of one-star ratings on Amazon, with many posting negative reviews and expressing outrage.

Company executives say the changes were made to provide “consistency” between their online and desktop product lines. They are quick to point out that the raw forms for Schedules C, D, and E can still be filled out manually in “forms mode” in TurboTax Deluxe, but they don’t recommend it. The company acknowledges that the full question-and-answer section for filling out these forms is missing, and that by using forms mode, validation checking is not done, and taxpayers cannot file their taxes electronically.

Dworsky believes that Intuit did not do enough to alert regular purchasers of the product to the changes in advance, thus depriving them of the opportunity to shop for competing products or to buy the right product to start with. Many consumers, he says, have been using TurboTax for 10 or 20 years and just naturally grab the one they have always used.

*MOUSE PRINT:

While Intuit provides an online and back-of-package checklist of which version is best for which types of taxpayers, it is essentially similar to the one they used last year when there was full inclusion of all the schedules, and thus it is easily overlooked or misunderstood.

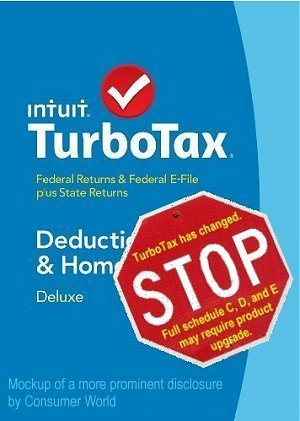

A more attention-grabbing disclosure like this mockup, Dworsky suggests, would not have been missed:

In the wake of complaints, Intuit is quietly offering free upgrades to some aggrieved users. Dworsky, however, is calling on them to do that for everyone automatically because of the abrupt changes, both as a goodwill gesture and as clear notice of the changes henceforth.

Meanwhile, recognizing an opportunity to grab market share, H&R Block, makers of H&R Block Deluxe, a competing program, is offering affected TurboTax users who have already purchased the program (Basic or Deluxe) a free copy of their software, which they say has not been crippled. To get it, consumers need to email a copy of their invoice, name, address, phone, and Windows or Mac designation to SwitchtoBlock@hrblock.com .

Intuit is not new to controversy or nickel-and-diming tactics. In 2008, it added a $9.95 fee to print or e-file a second return from TurboTax, but quickly rescinded the charge following a storm of criticism. And for years, it has arbitrarily “sunset” (deactivated) the online downloading and electronic bill payment functions of its popular Quicken checkbook software, thus requiring consumers to buy a new version of the program every three years.

Your COMMENTS are welcome below.

Of course, the ultimate answer is to simplify the tax code so I don’t feel the need to deal with software, but that’s a different argument.

I’m one of the lucky people who always has a simple tax return so I end up using the simple and free versions of tax software.

This situation makes it seem like Turbo Tax was intending to lose business. Unless H&R Block and other comparable software already used the same tactic of price upgrades, I would have done just like H&R Block and taken advantage of the opportunity to look like the more consumer friendly software.

As of the writing of this comment Turbo Tax has an overview that states schedule C is not included in the deluxe version while D and E are. I still think it is important that people read what they buy each time, especially for things that can easily change every year. I don’t know if the information was available from the beginning, but I can understand why users assumed they could use the same Turbo Tax version.

Just bought the program from BJ’s yesterday and haven’t opened it yet so today I am returning it. BJ’s had 2 different versionsn of the “Delux” program on sale. They were packaged slightly differently and were priced differently but the print on both boxes was the same.

Thanks for the information. I had $10 in MAX Rewards and Office Max had TurboTax on sale for $10 off so made the purchase we do every year. We’ve been skunked. What’s the best way to get them to give you the free upgraded needed?

Well Gayle I say return the piece of crap software now and get something else.

You really need just two versions of the software with the current tax code. Federal and State.

Wayne though is right… the ultimate answer is to simplify the tax code so I don’t feel the need to deal with software, but that’s a different argument.

Another case of boardroom break-even analysis – how much more will the company make versus how many customers will the company lose. If the answer is a net gain, then go for it! Sad

As a 15 year user of TurboTax I am extremely disappointed that this has happened; while we have no investments, one of us needs Schedule C and even though in the past couple of years it has not breen terribluy user friendly (C, that is), it has overall been an excellent program.` What

may make t difficult to switch to anothr tax program is the amount of carry over of data and

some calculations built in each year from prevcious tax returns which now won’t be available

except when paying the much higher price. I will until mid February before deciding which to

purchase.

I saw this when I purchased the program, but it is very in line with the pricing model used by HR Block and other tax services. There is a value proposition to do your taxes with Turbo Tax and I always felt they were giving away the service. At the price of 70 dollars you still get an unbelievable cost. Try to get your Schedule C, D, and E done for 70 dollars at one of the tax services. It will be 90 to 100 a form, so while we never like being dupped it was a great bargain for years.

I can’t wait to read about the TurboTax sales figures next year. 🙂

I too am hugely disappointed in TurboTax. I am a 14-year user of their Deluxe software, so naturally that is what I purchased for the 2014 tax year. I installed it, but found it did not support forms it had supported historically. I returned TurboTax Deluxe. The Premium version is too expensive for me as I am newly retired. I guess it’s back to paper and pencil.

Good reporting, hope lots of media pick up on this. That surely would put the spotlight on this issue.

As of this writing, just over 60% of ratings on Amazon for TT Deluxe (this year better termed TurboTax DeLousy ?) give the product ONE star. Bad for any product.

I try to read comments on Yahoo before any purchase, as I did when I had planned to put TT into my cart for a future purchase later this month. Glad I did, because now my cart has the H&R Block product that works for my taxes with importing my investment information for Schedule D.

I really thought I mis-read the product this year before purchasing. I decided to leave it, and do some research. I have used TT over 18 years, and other than the year they tried to charge for printing, this is the first time I have been really disappointed in the product and see it now as a cash grab. This is the year I will go to the competotor’s product. TT should have let users know ahead of time of the changes in their product, instead of holding them hostage once the product was loaded! Terrible way to do business!

I too have used TT for 15+ years. Will not use it this year. A great solution is to check with your local senior center. They have trained people from AARP that will prepare your taxes and efile it for FREE. There are some exceptions, for example, you can not own your own business or have rentals. Give them a call and see if they can prepare your returns. They do excellent work, I know, I have been volunteering for them for the last 5 years.

By ripping out these features, Turbo Tax has made a deadly mistake of “New-Coke” proportions. Looks like I’m buying their competition this year.

I just went onto TT and the Premier was $50. Delux was $30. Home & Business was $75. All three had substantial discounts.

Edgar replies: Rick, you are either looking at the ONLINE version. The desktop version, which this story is about, is higher. Mouse Print* is talking about the one you buy in the store, or download actually just went up $10 for each item (list price).

aww-full sneaky. Hope HR Block software imports last year’s TT info – if it does, I’m there in a flash.

Edgar replies: It does import TT.

Thanks for this tipoff. I buy TT Dlx every year for the past many years including for 2014. I had not yet noticed that they removed some functionality. But I have for a couple of years been unhappy with the way Intuit does business by promising TT buyers a 50% discount on the latest update to Quicken. They do not coordinate between the two products, so even if you have TT “Advantage” which means a standing order for TT each year, they make it extremely hard to get the 50% discount on Quicken. I’ve had to engage in lengthy online chats to finally get this discount. Before you can order Quicken at 50% off, They make you wait roughly a month or six weeks from your card being charged for TT by requiring that you cannot ask for the Quicken discount until your TT order has shipped. They seem to like promising this discount, but their system ensures that only the most diligent or masochistic customers, or those with a lot of time on their hands, will actually receive it. I’ve complained to Intuit about this for a couple of years but I have not seen any improvement. It seems deceptive, just like this stealthy stripping of functionality from TT Dlx.

PS – in the many weeks while you wait to be able to claim your Quicken discount (which they don’t come out and tell you will be required) they send you numerous offers to get Quicken at a much smaller discount, like $10, saying simply reply to take advantage of it. Maybe they think that busy people will simply take the lesser discount and not bother to ask for the 50% discount.

Can I use the TT Deluxe if I have a mutual fund which dividends are reported as ordinary dividends (ordinary income)? Will I be able to enter that amount $150.00 or so, without any hassle? Or will it require me to upgrade to Premier. H&R Block local office says I don’t need a Schedule D.

just purchased Deluxe yesterday, tried it out last night and had to do the $30 upgrade..was terribly disapointed as I had not heard/read anything about the change, and the box SHOULD have told me ! I will be asking for a refund of my upgrade $ .. and we’ll see how it goes. For me to change brands and not have the import of last year it would be a pain to change, I do returns for the entire family ….

Though I do wish I had read this article yesterday so I would have outright purchased the correct package and not had a financial surprise in the middle of using the software.

Edgar replies: Jeanne, H&R Block Deluxe *DOES* import your last year’s TT Deluxe info.

“Company executives say the changes were made to provide “consistency†between their online and desktop product lines.” What a bunch of bull – if they wanted to be consistent why didn’t they add Schedule C and D to the online version? This just doesn’t pass the smell test to me.

They also told me they could only identify customers that bought TurboTax directly from Intuit. I’ve had to register EVERY year and have to go thru them to eFile, I don’t believe they can’t notify everyone.

Does H&R Block program import data from TT that I used last year and installed on my computer?

Edgar replies: Yes, H&R imports last year’s TT data.

They are doing same thing with quickbooks. The prices are going sky high, you download one version and get another. If you have 1 employee its one price, then extra for every other one. You call the company and get so many promises and different answers when you want to buy their products. Then when you have problems you cant get a straight answer.

So anyone who can come up with a similar set of programs, offer excellent service and not rip off their customers will be a multimillionaire in days !

This SUCKS, big time. Just bought TT Deluxe yesterday at Costco. After 20 yeas with TT, I will return it unopened and go to H & R Block. You blew this one TurboTax. Talk about Greed!

Signed: Disgruntled ex-customer

I fortunately saw an article on USA Today Money section on my iPad this morning. I had planned to install it today, instead returned it to my local Staples for a full refund. Spoke with the store manager and he said they are getting bombarded with returns. Told him it wasn’t his fault, but if he wanted to minimize his business impact from Intuit’s GREED, then he should post his own sign above the cardboard storage display alerting customers to the bait and switch tactic.

Be interesting to see what they do as their spokesperson suggested people call Intuit to complain. After 20 years why should I bother – time for change.

And I agree with others, the making it equal to online is complete bs. I would NEVER file my return with their servers/cloud, etc. I want it on my pc’s storage so I can protect – don’t trust any company these days with MY personal data.

But I’ll give their CEO’s office a call on Monday when they are open – get the public number from their SEC filing, and ask for the chairman’s office. You’ll likely get “executive resolution” and see what they do.

Another reason to put the deduction for tax preparation expenses in the section not subject to the 2% floor.

Here is a discount link to get TurboTax Premiere for $30 which might help some of you, courtesy of slickdeals.net.

https://turbotax.intuit.com/personal-taxes/?view=desktop&priorityCode=3468345144&cid=all_08rb208_aff_346834565

Turbo Tax… I’m a 10 year user of your software… your deceitfull ploy amounts to a classic “Bait and Switch.” I’m glad I read this as I’ll never use your software again!

I contacted Intuit and was given a free upgrade to include stock transactions.

The rep I talked with said they were given me a refund for my original purchase ($59). This transpired after I said no more purchase from Intuit.

Have used TT for as many years as I can remember. Age 80. Will be trying H & R this year. Don’t like doing business with what I would call a (SNEAK).

I called H&R Block and although the most popular financial institutions are included for import, some of the less common are not included (for me a couple of Mutual Fund families…yours may be on the list). I guess you can check with your financial institution. I will use TT for this year since I reverse numbers easily and like the import.

I wish H&R Block would have the list on line…the customer service agent had one so why not put it on their website. To be fair, I didn’t find a list of financial institutions included for import on the TT website either, but having used them in the past, I know they have what I need and they have over a million financial institutions.

Edgar replies: Lane, this was one of my big concerns also because H&R did NOT have a list anywhere of what financial institutions it could import 1099s, etc. from. They sent me a list (and mine is on it):

Alger Funds

AllianceBernstein

American Beacon Funds

American Century Brokerage

American Century Investments

American Funds

Ameriprise Financial

AssetMark

Baron Funds

BBVA Compass Investment Solutions

Betterment

Citi Personal Investments International

Citi Personal Wealth Management

Citi Private Bank

Citibank.com (Investment Accounts Only)

Charles Schwab

Columbia Management

Credit Suisse Securities (USA) LLC

CRI Securities, LLC.

CUNA Brokerage Services, Inc.

D. A. Davidson & Co.

Deutsche Asset & Wealth Management

Deutche Bank Alex. Brown

E*TRADE Securities

Edward Jones

Federated Investors

Fidelity Investments

First Command Financial Planning

First Eagle Funds

Gabelli Funds

GainsKeeper

Harbor Funds

Hefren-Tillotson, Inc.

Homestead Funds

Invesco

Ivy Funds

J.P.Morgan Funds

Janus

John Hancock Investments

Loomis Sayles Funds

Lord Abbett

MainStay

Madison Funds (MEMBERS Mutual Funds)

Merrill Lynch

Morgan Stanley Wealth Management

Natixis Funds

NetXInvestor

NMIS, LLC

Oakmark Funds

Oppenheimer

Pershing Advisor Solutions

PIMCO Funds

Principal Funds Inc.

Princor Financial Services Corp

The Royce Funds

RS Investments

Securian Financial Services, Inc

ShareBuilder

The Investment Center

T. Rowe Price

TD Ameritrade

TIAA-CREF Brokerage

Trading Direct

UBS Financial

Vanguard Group

Waddell & Reed

Weitz Funds

Wells Fargo Advantage Funds

William Blair Funds

I’ve been using TurboTax (lately Deluxe) for over 20 years, and need Schedule D for investment sales. It appears Intuit is offering a free Deluxe-to-Premiere upgrade to those of us who have used Deluxe but now cannot. I assume this is only a temporary / one-time “fix”.

I also understand H & R Block’s Deluxe software has the Schedule D (etc.) features and will (mostly) import from the previous year’s TurboTax Deluxe.

Does anyone know if Block Deluxe can import a return created by TT Premiere? Or would using Premiere this year require H&R’s “Premium” version next year? (The H&R website just says it will import from “TurboTax”; no version is mentioned.)

Turbo Tax has always been an electronic novelty to me. So going back to a $.49 mailing will be a return to my calculate and copy…let the IRS enter the data. I’m not one to make the IRS my savings program…I’d rather owe them. I’m not one to make Turbo Tax executives airline baggage millionaires. Turbo Tax use to be a service…not any more.

This nothing new folks. It has been this way for years when using Deluxe. This is just a ploy to get people to switch tax companies. It is called bait and switch

Thank you Edgar…that should be helpful to others. The customer service agent did check for me and of course all my brokerage firms were there…I expected they would be, but not my mutual funds. I think I will use Premier and buy H&R Block also to see what I like better for next year.

So in order for TT to work across platforms, they have to reduce the capabilities of the software? Or another way to look at it, if you pay the extra fee to get the same product you had last year all of a sudden it works across platforms?

While the TT Deluxe fine print did point out that something was “New – Some features are now only available in these versions of TurboTax,” you have to read the entire box very carefully to understand they eliminated capabilities. When you buying the same box for decades, you really don’t expect you have to read everything. Is this the way an up front company operates?

My unopened TT goes back.

Seems that the persons that have to upgrade are mostly made up of people who have lots of investments and generally have the money anyways! They are the ones usually complaining the loudest too.

Doesn’t everything you buy in life eventually get more expensive.. Why should tax preparation be any different?

Edgar is several times quoted above as saying, “Yes, Block imports last year’s TurboTax data”.

Moving from one supplier to another (for instance TurboTax to Block or TaxAct) each supplier “says” you can import the prior year’s data. However the importable data only includes basic personal information. It does NOT include such as carryover deductibles, long-term depreciation calculations, etc. Hand-entering such is a tedious, if not impossible task. At least I tried and my import was incomplete.

Now, if anyone has been successful in importing COMPLETE data such as this, tell us how you accomplished it.

Edgar replies: George, I have barely started my return with H&R Deluxe. Looking at my actual Schedule D, for example, it already shows my carryover long term gain or losses from last year. For Schedule C, the form already has some item that I depreciated over time with the yearly amount figured in. I did nothing special to import my last year’s TT Deluxe file except “import.”

Treese – my husband has about $4000 in a trading account that he trades actively, and I earned about $7000 from freelance work last year. This means we need both schedules C and D, even though we do not exactly have lots of money. (We do have other income from Social Security and pensions; it still doesn’t add up to all that much). Don’t think that just because you have non-salary income it automatically means you’re rich.

I suspect most people who do have lots of money also have accountants who do their taxes, rather than doing them themselves either on paper or with software.

Same thing happened to me. Offered a low 14.99 fee, then when I entered IRA contributions, says I need to upgrade to premium for 34.99. Thats NOT including state. When I entered state, then it went up to almost 80 dollars! What a ripoff! I could go to a tax office and have someone do it for me for the same price or cheaper. Crooks..thanks for wasting my time! LAST time I ever attempt to use turbotax.

I just got off the phone with them. They upgraded me for free after complaining.

Have been a TT user for many years but I’ll now buy H&B deluxe. Those people who complain to TT and get a free upgrade this year will have to buy premium next year as TT will not do this again. Their stock price will drop as people will sell because of sneaky business practice.

I would recommend to buy Turbo Tax Deluxe, unopen it and return to the store back.

Vanguard offers its customers Turbo Tax Premier online for $39.99. Amazon Prime members can get H&R Block Deluxe online version for $34.42. The online version has worked very well for me for years so don’t see why to spend more for the downloaded version. Amazon Prime members can get H&R Block Deluxe for $34.42. If you are eligible for those, the price difference seems negligible.

I don’t know why this went up just now – Deluxe doesn’t include investments and rentals for how long now? 3-4 years I think or even more. Nobody complained. Now it’s like tragedy…

Edgar replies: Last year’s box made you believe you had to upgrade to higher versions if you had investments, self-employment or rental income. In fact, the interview still included them. The higher versions had additional guidance for years, but you didn’t need to trade up. This is the first year the interview section for Schedules C, D, E, and F were actually removed.

I have used TurboTax Deluxe for several years and am very disappointed that they placed Greed over Customer Satisfaction. I purchased TurboTax Deluxe ten days ago and returned it yesterday. I will be a HR Block customer in the future.

I have used Turbo Tax from the beginning DOS version and am totally amazed at the greed that Intuit is exhibiting. Plus, they must think us stupid to believe their explanation of why the Deluxe version no longer includes Schedules C, D, E, and F.

Intuit has a market-dominnt position that they’re trying to wring every $ out of.

They use the same tactics with Quickbooks and Quicken (sunsetting support and pulling features from perfectly viable software, forcing an upgrade purchase). They just suck. If a competitor would come up with a viable alternative, customers couldn’t run fast enough from Intuit.

But they’ve heard all this before, and they just don’t care. They answer to investors, not customers.