With stories about identity theft, stolen social security numbers, and compromised account information filling our newspapers weekly, no wonder a number of companies have sprung up to help protect you.

With stories about identity theft, stolen social security numbers, and compromised account information filling our newspapers weekly, no wonder a number of companies have sprung up to help protect you.

LifeLock is one such outfit. Unlike ID Vault , previously mentioned in Mouse Print* as a service to protect your online login information, LifeLock aims to protect your personal information from being used to commit ID theft for $10 a month.

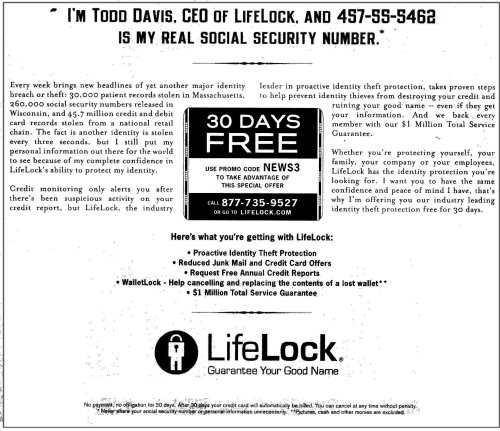

In a full page newspaper ad [Boston Globe, Feb. 13, 2008], as well as in TV, radio and web ads, LifeLock’s CEO, Todd Davis, publishes his own real social security number to show how confident he is in his service being able to protect him. And they even offer a $1 million dollar service guarantee.

The asterisk after “social security number” goes to this fine print disclosure:

*MOUSE PRINT:

“*Never share your social security number or personal information unnecessarily.” Â

So besides doing exactly what he counsels prospective customers not to do — putting personal information out there for all to see –Â he has also voided his own $1 million guarantee.

*MOUSE PRINT:

“18. … In addition, you agree that you will not purposely engage in behavior that will put your personal information at unnecessary risk, such as leaving your PIN or passwords in obvious places or publishing your Social Security Number. “

And, in the irony to end all ironies, Todd Davis had his social security number stolen last year after publicizing it in advertising. It was used to fraudulently obtain a $500 loan. [see story] Apparently the company found the guy who did it and because they allegedly coerced a confession from him, no prosecution could go forward.

That doesn’t exactly create the type of first person testimonial he might have been hoping for.

Next week: We will look deeper into what services LifeLock offers, and the questionable way part of it works.

Ok, besides the patent stupidity of that stunt, I’m wondering how long it will take before “obvious places” becomes a contentious expression. On one hand I understand that nobody wants to insure idiots. On the other hand, I can’t help but get the feeling that LifeLock will eventually try to deny claim by arguing that sensitive information was left in “obvious places”.

If I put sensitive information in a home-safe and as fate would have it the burglar is resourceful enough to break into it, could they argue that sensitive information in a home-safe is an “obvious place”? Seems obvious to me that sensitive information would be put there.

wow, they offer reduced junk mail and credit offers (how is that id theft?). they also offer free annual credit reports (I thought that was already free!). At $10 a month I would be paying $120/year for this service. This sounds like a rip off to me considering that the typical ID theft insurance costs between $25 and $50 a year.

Yea, I have read that their CEO did get his SSN gamed last year sometime, a little ironic. I use a company called TrustedID, similar, but not as obnoxious.

-Ethan

There is also LoudSiren. IdentityTheftLabs.com compares and reviews all three.

Lifelock only looks at financial ID Theft. There are four other catgories. What would you do if you were arrested for a crime committed in your name?

Gotta give the guy credit for trying to put his money where his mouth is, but (like others above) this seems like a service that is destined to fail as people get their claims rejected left and right because their wallet was stolen and had a SS card in it, or you filled your SS# on a form that was copied by company X and left on the table where someone stole it, or other “obvious” things.

If anything, the fact that someone stole his ID and got caught proves his service works. He doesn’t guarantee that your ID won’t be stolen, just that you will know about it and be protected if it does. I am sure you can find cheaper services but if people are willing to pay for this service, then so be it.

As for the folks talking about the “obvious places” line, do you not think that you are agreeing to the same common sense approach everytime you sign anything financially? Is a car insurance company going to pay your claim if you left your keys out in the open? Yeah, probably not. These companies are for profit. They are not in existence to cover stupidity, there is too much of that going around for them to stay in existence if they were.

It is perfectly factual and correct that an individual may place his/her own fraud alerts at the three major credit bureaus. It is also correct that anyone can opt out of 3rd class mailings (which include pre-approved credit cards and bank checks) at no charge. However if your personal information is stolen either via a lost or stolen wallet or online that’s where the real trouble begins. LifeLock will guarantee recovery of all monies fraudiently spent, hire lawyers at no cost to the subscriber and guarantee replacement up to $1,000,000. A good example of their service is using the experience of their very own CEO, Todd Davis. A clerk did not verify the ID of a check he cashed. Had it been you or me LifeLock would have done exactly what it is supposed to do: Recover the funds. This is what I pay for. I do not pay for services I can (and have) set in place myself. I pay for the $1,000,000 guarantee, the non-hassle of having attorneys take care of business for me and replacement of my cards and personal info in one easy step.