Car rental companies are notorious for advertising low rates but then when you add all the taxes and fees, the price can jump up dramatically.

Recently a friend rented a car from Enterprise in the Boston area and he noticed a number odd extra charges added to his bill.

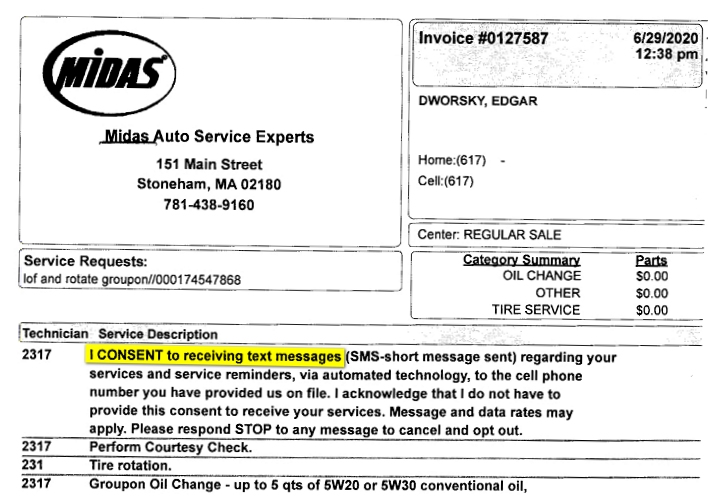

*MOUSE PRINT:

What these fees are for is not obvious. Poking around online reveals that the Commonwealth of Massachusetts is directly responsible for two of them, and indirectly for the third.

The parking violation surcharge, which one would think is only imposed if you got a ticket, is actually mandated by state law. It says that the rental company will not be liable for traffic tickets if it collects a sixty cent surcharge from the car renter and pays that to the city. (See G.L. c. 90, § 20E(i))

The $2 per rental police training fee is another creature of the Massachusetts legislature. They thought it was a clever way to help pay for police training. (See story.)

And lastly, the “VLC Rec Fee” is a made up fee by rental car companies. It stands for “Vehicle License Cost Recovery Fee.” It is designed to recover the estimated average daily cost per vehicle of the charges imposed by the government for the rental car company to title, register, inspect, and plate all vehicles in its rental fleet. Enterprise charges a whopping $2.80 per day for this.

Interestingly, Illinois has a statute about this particular fee that says if the total fees collected exceed the rental car company’s actual costs of registration, etc., it may keep the excess, but has to adjust the fee charged to renters downward the following year.

Enlarged for better readability

Enlarged for better readability