MrConsumer has a rarely used Chase Freedom Visa card and recently received the following email:

Immediately, a wave of mild panic set in. I scrutinized the email to make sure it was not a phishing attempt. But it really did come from Chase and the button really did go to Chase.

Clicking that button triggered a login request. After filling in the form properly and including a six-digit code I had just received in a separate email from them, I was faced with a request to do an even more elaborate verification process that required calling them and speaking to an automated system. So I did that and was now given a new 7 or 8-digit code to enter. At that point, I was able to get into my account, and saw nothing out of the ordinary. There were no new charges on my account.

So… I called Chase customer service. Before you can speak to a human, you have to pass a voice-verification test, where they ask you to say your name and address. They presumably have made a voice print of prior calls, and then they compare that to my voice today. Then you can speak to a representative. The representative looked at my account and saw no activity and said nothing was wrong.

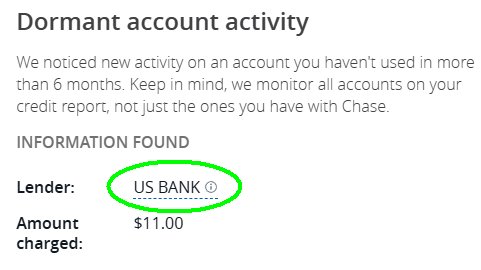

While on the phone with her, I made my way over to “Chase Credit Journey” which I don’t think I have ever used. You can check your credit score there, and see your Experian credit report. There, under alerts, was this:

*MOUSE PRINT:

It said an account I had with US Bank — not Chase — showed some activity after being dormant. What? Chase is telling me about a problem with US Bank? Perhaps I should be grateful to Chase for pointing out a potential problem, but I wasn’t.

Like the Chase card, I rarely use my US Bank AMEX but I did deliberately buy subway fare with it a few weeks ago to keep it active. So, while the alert was accurate, it caused needless worry.

Advice to Chase: If you are going to alert someone about possibly problematic activity on a dormant credit card, it better be about a Chase card. And if not, the warning email should clearly state the activity is NOT on a Chase card but rather on another account the bank monitors on customers’ behalf.