On the way back from Washington, DC a couple of weeks ago, MrConsumer was stopped by a TSA official before entering the waiting line for security. He scrutinized my boarding pass and diverted me to the TSA Pre-Check line. Thinking he made some mistake because perish the thought would MrConsumer pay extra for a pre-screening program to expedite his trip through security, the TSA official said it was a random choice that I was being directed there.

Okay, I thought, maybe this is a heightened security check for random passengers. But how much more could they ask me to remove?

Turns out that pre-check is an expedited process to go through security. No removing of shoes or belts. No taking out your plastic bag of toiletries. No laptop in a separate bin. And no going through the full body scanner. All I had to do was remove metal from my pockets and go through the old-fashioned metal detector.

A check of the TSA website reveals that the TSA Pre-Check program is indeed a system being rolled out across the country. It is currently available at seven airlines, including American, Delta, United, and US Airways in selected cities. They have a secret formula to figure out who is harmless enough to let through security with only minimal screening (and clearly the system isn’t working too well if they let MrConsumer through

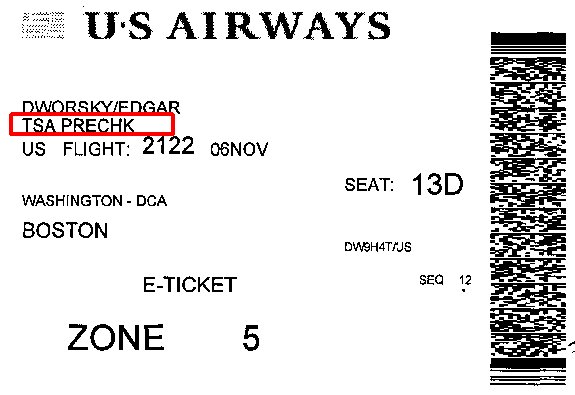

How do you know if you have been selected to cut the long line, and go express through security?

*MOUSE PRINT:

Look right on your boarding pass in most cases for that designation.

Based on the details found at the TSA Pre-Check program website you do have to pay $85 for a five year expedited “pass” through security. So maybe the TSA is taking a page from product manufacturers and offering a free sample to random passengers in the hope that they will buy into the program.