We received a complaint from Phil S. saying that his Medicare advantage plan’s seemingly generous $240 annual allowance toward the purchase of over-the-counter health products was deceptive because the third-party company he was required to buy them from “grossly inflated their price” on certain items.

He’s referring to Tufts Medicare Preferred, a leading Medicare Advantage brand from Tufts Health Plan. They offer a set of plans for seniors in Massachusetts (and elsewhere) for those who want an all-in-one plan instead of having to deal with Medicare and then a separate supplemental insurer.

One of the extra benefits that some of their policies provide is a $240 annual allowance ($60/quarter) that members can spend toward eligible over-the-counter products like pain relievers, eye drops, vitamins, etc. That seems like a quite generous bonus benefit that Medicare itself does not provide.

In order to take advantage of the free OTC products, rather than allow you to go to your local CVS or Walgreens, Tufts emphasizes use of the OTC provider they have contracted with — Medline — and provides their catalog and price list online to members. Tufts is also now allowing purchases through Walmart.com, but does not provide a list of the covered products there nor a price list, and a $6.99 shipping fee on orders under $35 may scare away some members who do not go to the store for free pickup.

*MOUSE PRINT:

4 Easy Ways to Enjoy Your Benefits [three of which are Medline]

Online through Medline — Go to thpmp.org/order-OTC, log in with your OTC card number and your Tufts Health Plan member ID number, and select the items you want to purchase.

The 2023 Medline catalog for Tufts members provides hundreds of covered items. And that’s where the problem begins when comparing those member prices to what Medline normally charges on its own public website.

*MOUSE PRINT:

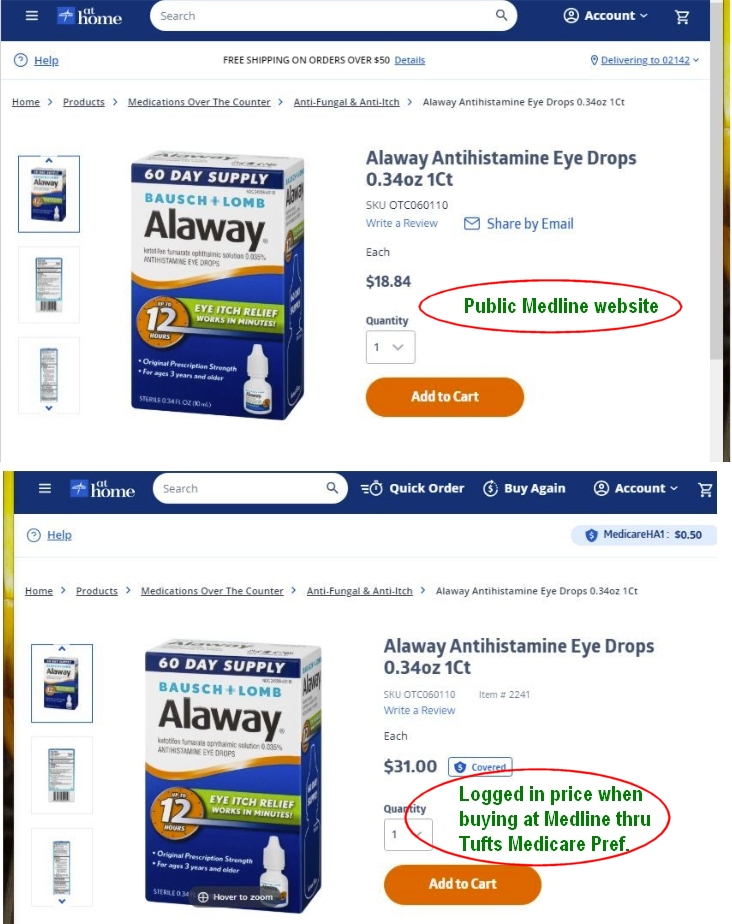

In this dramatic but atypical example provided by our consumer, these eye drops are 64-percent higher when using the Tufts benefit compared to what Medline charges on their own public website. [After we provided the insurer and Medline with this example, rather than lower the price for Tufts members, it increased the price to $31 on its public website!]

To check the price of more items, we chose 10 from the Medline/Tufts catalog of allowed products and compared them to what Medline charges for those same items on its public website. The Medline/Tufts price was higher most of the time. It should be noted that Tufts members do not directly pay extra for shipping, while the Medline public site charges a flat $7.95 for orders under $50.

*MOUSE PRINT:

Higher price noted in red

Higher price noted in redOur consumer believes that Tufts is deceiving the public as to the actual value of the OTC benefit in that it is worth less than the promised $60 per quarter because of Medline’s inflated prices on many items. When Medline’s higher prices for Tufts’ customers are only a couple of bucks more, however, that is understandable since shipping is included in those prices but is not included on Medline’s public site.

But how do the Medline/Tufts prices compare to real world retail store prices? We compared the shipped prices of a dozen items that were available at the Medline/Tufts site and at Target.com. Target was cheaper on all but one of them.

*MOUSE PRINT:

We asked both Tufts and Medline to explain what is going on here given the expectation that pricing for a large affinity group like Tufts Medicare Preferred members should be lower than what the general public pays. We also inquired if it was fair that Medline charges Tufts members more on many items.

A spokesperson for Tufts responded to some of the issues we raised about Medline’s higher prices, and incorporated an explanation and comment they received from Medline, saying in part:

We aim for Tufts Medicare Preferred members to receive the most favorable pricing possible when using their OTC benefit. While we find it unfortunate that there are small discrepancies in the pricing on Medline’s website from time to time, pricing for our members is set six months before the benefit year and based on available market data. Tufts Medicare Preferred pricing includes direct shipping and access to live customer support for all phone or online orders.

Medline strives to provide fair and reasonable prices for all products offered to health plan members.

It seems to us that Tufts Health Plan has not done the best they can on behalf of their members:

1. They do not solicit competitive bids for the company(s) to manage their OTC program. If they did, they could encourage bidders to compete on the prices they will charge for the OTC products offered to their thousands of members.

2. The OTC program materials online fail to clearly outline the Walmart.com option and fail to list the covered products/prices as they do with Medline. Tufts says such a list does not exist and your order will simply be rejected by Walmart if you guess wrong and an item you choose is not covered. How crazy is that? At a minimum, they could have at least provided members with a direct link to the virtually hidden special Walmart Medicare OTC Network website where a curated list of products is shown, but they didn’t.

It is our hope that this story will prompt Tufts Health Plan to take a critical look at their OTC program with an eye toward making it a better value for their members and easier to use. And there is a ray of hope in that regard in one of the final comments that Tufts sent us:

We are currently evaluating our options for future benefit years, which could include additional or different online retailer options, price matching as well as the ability to purchase from retail locations.

I have Humana Medicare Advantage and they also use Medline. I get $75 per quarter for OTC products. I have stopped using my allowance because the majority of Medline products are inferior to the name-brand items. Some are outright laughable because of quality and price. They show pictures of the name -brand items in their online catalog with the caveat that they “may” substitute items. I would rather they just send me a quarterly check.

Small discrepancies says Tufts?!?!!?!?

The price difference does not look that small on some of the products. Especially those eyedrops.

I am going to agree with Jennie here… Just give me a check in the mail and I will spend it on what I want.

I get my Medicare OTC through CVS. I checked a few prices, and the prices are higher on the public CVS site than on the Medicare site. However, I only get $40 per quarter

I have found the same issues with Humana. Humana has a program that offers vouchers toward OTC medicine and medical devices. I believe the pharmacy they use is Center Well. When checking the prices on their site, I find that they are more, sometimes a lot more, than local store prices. I do appreciate the savings but I can’t help but notice the high prices. Seniors and insurers are being scammed.

Reminds me of my military days of contracts and procurement. Standing offers for items that were 10-fold yet the same items and patent numbers at home depot were far less cheaper. Someone was making good coin….

The goods carried at Home Depot are military-grade?

The same principles – if you will – apply to United’s benefit plan, managed by Solutran. Walmart is an option for price competitiveness; but that’s not readily clear in materials, products aren’t marked as qualifying – you have to nearly complete checkout to find out, and packages of larger multiples don’t qualify. Solutran’s own catalog has one bottle of allergy spray the same price as package of six at Costco. When I wrote Solutran about this pricing issue, they required I write back with ions of backup data, and then ignored my effort. Consumer opinion: Solutran should be satisfied with the volume of $s directed to them for purchase, but instead takes advantage of the largely captive $s to gouge more $s out of the deal. Consumer opinion 2: United should see that this benefit looks bad on its reputation, especially when I am exposed to this ripoff by their agent several times every quarter.

I hope you’ve complained to United (UHC, I assume), and to your employer, if the plan is sponsored. Call the office of your state assembly member or state senate member to make them aware of this issue as well, and they may recommend the appropriate state agency with whom to file a complaint.

This kind of non-sense reminds me of another reason why I don’t have a Medicare disadvantage plan.

Medline also charges Massachusetts Sales Tax on Tufts OTC purchases, even though sales tax law says that only the net cash paid for products (after coupons, etc.) is taxable; thus, free stuff is not taxable to the consumer. (Tufts’ previous OTC provider did not add tax.)

This and all previous comments have decent points, but the bottom line is that Tufts is giving the members $240 of FREE stuff and no shipping charge, which they don’t have to do. So perhaps it’s wiser not to rock the boat, lest they decide to reduce or even shut down the OTC program!

It’s only free if you’re paying nothing extra for that plan feature compared to your alternative. If you’re paying an extra $200 per year for this plan vs the alternative that doesn’t have this benefit, believing that you’re coming out ahead by $40 per year, but actually receiving less than $200 true value in return, then the products not only were not free, but actually cost you more than you would have spent by buying the cheaper plan and cheaper OTC products on your own.

I am in a plan whose premium per month is $0 – zero dollars — no cost. I receive and use the $240 annual OTC benefit.

I am fortunate to be insured by UHC which also offers an OTC benefit per quarter. They recently moved from First Line mail order OTC to what they call a U-Card which CAN be used as a walk-in form of payment at Walmart, CVS and Walgreens, or by mail from First Line. It can’t be used at every store – Target has a robust selection of OTC products, but doesn’t accept the card – but this really allows one to get more bang for the buck. As someone else mentioned, one does not know for certain whether the items are covered until trying to check out at the register. In my case, the OTC benefit has been a boon, especially now that it can be used at some physical locations.

They also provide rewards for good behaviors. One can receive small amounts of cash for having an annual checkup, receiving a flu shot, exercising for at least 30 minutes on 10 of the days each month, etc. These funds can be used for anything. They also make exercising easier by providing free membership at several gym locations in my area.

I also have UHC and take advantage of all the perks you mentioned. If you download the app, you can scan an item when shopping and it will let you know if your OTC or rewards money will cover it. I’ve been using my rewards dollars at Safeway ?

Never use an “Advantage Plan” unless you know you will healthy and not have to make a claim. There have been many articles here about those kinds of plans and reasons to stay far away.

Just use straight Medicare A and B with a supplement.

Same for me and my brother.I have Medicare Advantage through Wellcare and his is Medicare Advantage through Aetna.We both have to use CVS for OTC allowance and the prices are higher than what they charge for items purchased at their stores.

I have this same benefit through Scan. I’ve called and complained to them about the rampant overcharging on products in their “catalog.” The prices are between 2 and 4 times more expensive than the products would be in the store.

For example: Reach Dental Floss is currently $1.35 at the 99 Cent store. It’s $4.00 in the catalog. This is just one example of the hiking up of prices for seniors. Yes, by all means, let’s cheat seniors.

The company that Scan is currently using just made a curious change to their catalog. Items are now either .25 or .50 cents more, making it much, much more difficult to use the actual amount you’re allotted and not go over or under, further enriching this company.

I’m certain this is done on purpose. I calculate that the amount I get quarterly: $175.00 is actually worth, approximately $40.00.

This kind of cheating, or let’s call it what it actually is, stealing, shouldn’t be allowed. Yes, these companies are entitled to make a profit, but they aren’t entitled to steal money from me or anyone else. And, they are enriching themselves by stealing from seniors. Shame on them.

Just adding that in plans I have seen, any unused balance is forfeited *each quarter* as well, another way they make sure you can’t get your full allowance without spending some additional money of your own on their overpriced products.

They are a real carnival ride of “dark patterns.”

https://www.deceptive.design/

My insurance company does the same thing. Offers a quarterly amount through a specific company. The prices on the company’s website are considerably higher than elsewhere.

My regular employer-sponsored health plan carrier has a similar “feature” – the “FSA Store”. I’ve checked it out, thinking maybe since it’s a big company, they contracted with an existing retailer to provide a convenient FSA-focused selection at normal retail pricing. But NOPE. It’s all very overpriced. As a feature, it’s pretty much useless. Free shipping doesn’t justify the higher prices. If you’re resorting to using the FSA Store, it’s because you have a lot of funds remaining, surely more than enough to qualify for free shipping with any online retailer. It’s probably really a repurposed Medicare Advantage OTC store, just there to fill out the bullet points on the brochure.

I’m a ways away from Medicare age, but from what I keep hearing and reading, Medicare Advantage plans use a lot of deception in their marketing, and don’t actually provide a good value.

I’m a ways away from Medicare age, but from what I keep hearing and reading, Medicare Advantage plans use a lot of deception in their marketing, and don’t actually provide a good value.

I heard and read the same stuff which is why I just signed up for UHC’s supplemental plan G. Several older friends and relatives clued me in on staying away from Advantage plans, especially if you have medical conditions. As my husband is a diabetic, we didn’t want to take the chance. We heard too many horror stories and in every case our friends and relatives recommended getting the best supplemental plan you can afford.