Please excuse the following unprofessional comment: the folks at Intuit who market TurboTax tax preparation software are a bunch of money-grubbing creeps. You will see why in a moment.

Please excuse the following unprofessional comment: the folks at Intuit who market TurboTax tax preparation software are a bunch of money-grubbing creeps. You will see why in a moment.

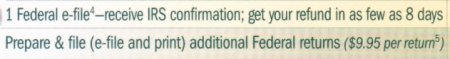

The company decided to pull several fast ones on purchasers of their software this year, including by limiting the usability of their product in a way they never have before. On the back of the box is the following disclosure:

MOUSE PRINT*:

The little “4” refers to a virtually unreadable footnote that says “Product includes preparation, e-file, and print of 1 Federal return.”

Translation: This year if you wanted to prepare a second return (say for a spouse or child) and merely print it on your own printer, Intuit was going to charge you $9.95 extra for each return beyond the first. What chutzpah!

At the same time, on their website, they are claiming “NEW – Free federal efile included”:

*MOUSE PRINT: What TurboTax does not tell you is they raised the price of the software by one-third from 2007 to 2008 to cover the “free” efiling. Last year, TT Deluxe retailed for $44.95 and was commonly available for $39.95. That price did not include $17.95 extra for OPTIONAL e-filing. This year, Intuit raised the price of TT Deluxe to $59.95, but included one “free” efiling. (For Costco customers last year, after a $15 coupon, the price was only $19.99. This year, the price actually doubled because the software went up to $49.99 there, and the coupon is only for $10 off that price.) So in essence, customers have no choice but to pay extra for efiling whether they want to use it or not.

These two policy and price changes caused an uproar. Consumers were livid that they had to pay $10 extra to print a second return on their own printer, and that they were being forced to pay for efiling via a $15 price increase for the product itself. And for once, consumers found a way to get even. They downrated TurboTax 2008 on Amazon, so that it was only rated as a one star product.

Then, on December 9, 2008, H&R Block announced that their competing software, TaxCut, would include completely free efiling without raising prices. Intuit gave in to the pressure three days later and issued a press release allowing purchasers to print unlimited copies of returns for free on their own computers (offering refunds to anyone who paid the extra $9.95), and they now included FIVE efiles. That is a bona fide savings compared to the $17.95 each they used to charge, but we are still paying $15 extra for that privilege.

Unfortunately, Intuit has a history of trying to take advantage of consumers by deliberately disabling online functions for its Quicken software three years after issue thereby forcing customers to buy the software again; eliminating, reducing, or hiding rebates on certain software and thus raising prices; and giving away non-upgradeable software as a bonus (forcing the purchase of a more expensive edition in the future in order to view the already entered data).

Here is this year’s hidden TurboTax rebate of $10.

I was online at Amazon to buy my usual TurboTax, having used it for longer than I can remember, when I saw the customer comments. By that time Intuit had changed their tune, but having been burned by them with Quicken before, that was the last straw. I bought TaxCut, which imported my 2007 file flawlessly, and I will never buy another Intuit product again. They changed their scam only after customers caught them. I won’t support their business “ethic.”

I think The Consumerist covered this first, better, and in a more timely fashion. This is just old news now.

I expected better of you Mouseprint rather than rehashing old news, especially at one measly post per week.

I switched to Taxcut years ago after Intuit added spyware-like features to its Turbotax product. They stopped that, but continue to raise prices and pull stuff like this, so I don’t see myself switching to Turbotax anytime soon especially when Taxcut is consistently cheaper and does just as good a job.

In fact, I don’t see myself using ever any more Intuit products. Quicken got pricier, slower and more complicated/buggy with every release, so I switched to Mint and wondered why I didn’t do so sooner. Mint saves me time compared to Quicken AND it works with every single one of my banks, unlike Quicken which refuses to work with banks unless they pay Intuit a bunch of money.

Quickbooks was so buggy and untested as to wipe out Mac desktops after you updated to their latest release. When I get my own business started, I’ll be going with MYOB.

Until Intuit radically restructures their company to better look out for their customers I won’t be looking at their products any longer.

I have used turbo tax for many years, but I will switch to Tax Cut this year.

Thank you for this article. I stopped using Turbo Tax on the web a few years ago because of these types of tricks. I switched over to TaxAct and have been very happy with it. It almost seems like Intuit has brain-storming sessions where they figure how far they can push consumers. We are not powerless and we *do* have a choice. Can you hear me now?

has anyone tried taxact online? I used it last year after having used turbotax for many years and just could not afford it anymore. anyhow, taxact seemed to work pretty well and I will probably use them again this year. our taxes are pretty simple though so we didn’t need all the features in turbotax.

TurboTax offers a great tax preparation software that is quite reasonbly priced. Try taking your tax information to a CPA (or even an EA) and see how much they charge you! Tax laws, IRS codes and forms are perpetually changing and that requires constant revision to any tax preparation software. Those costs have to be covered – Intuit is in business to make money; not to make life easier and cheaper for you. If you can find an easier, cheaper software to prepare your taxes then by all means go an use it – TurboTax will have to figure out a way to keep its product competitive in a free market economy. Simply put though, and in my humble opinion, TurboTax is the most comprehensive tax preparation software available in its price range.

I have a cheaper way of filing my taxes, I do it myself.

I have discovered (not to my surprise) that Intuit still won’t let the little guy come up, as the hidden rebate that you speak of does not apply to anyone who purchases their TT at Wal-Mart, Sam’s Club, Costco or Target. They advise that they have already low prices so there is no need for a rebate. In this day and age, every penny counts and I would have liked to use the Costco coupon and the Intuit rebate for more savings. That stinks!!

I have used Turbotax for fourteen (14) years.

Every year they send me their software through the U.S. Mail.

This year, I was able to see online the crap they were trying to pull and never installed it.

This week I installed TaxCut.

So long “Turbotax.”

Ditto on Howard’s comment. Used TurboTax for as long as I can remember. As soon as I read about TurboTax’s new antics, I tossed the disc to the wayside. I purchased TaxCut the next day.

I don’t buy turbo tax but i’ve used it for the past 2 yrs for free. I go to irs dot gov & b/c my income is below 50k, i qualify for the freebee. I hope the same is true for this year. I don’t file electronically, rather i save my return in pdf format, print it & use snail mail.

I will however keep my eye open for a freebee taxcut at the irs site.

Um, actually this isn’t new. I’ve had multi-state returns for years, and I know for sure that I was charged extra to file multi-state returns last year (2007 taxes). I had worked in 3 states and had to pay the extra fee twice for them.

However, that is not meant to belittle your effort to make the ‘cheat’ public knowledge. BRAVO! Mouse Print.

As I recall, the year prior to that, it wasn’t even possible to do multi-state.

Note that most of the $10 rebates on Turbo Tax Deluxe/Premier

not valid for products purchased at retail in New York state.

The Intuit FAQs provide no explanation for this exception.

Evidently Amazon pulled some Mouseprint of their own if you believe the comments on the TurboTax 2008 page. See http://www.amazon.com/review/R20O1FSX0KK9LS/ref=cm_cr_dp_cmt?ie=UTF8&ASIN=B001GL6QHS&nodeID=229534#wasThisHelpful

I just looked at the price, my good, it is about $90. Double the price in couple years. We should stop use it for one year. I will look at other products. It is a good things, use more than one product. lets trash Turbo tax for 2009

TAX ACT.

I Never paid more than $20 for BOTH state and Federal E-file. Federal E-file is free.