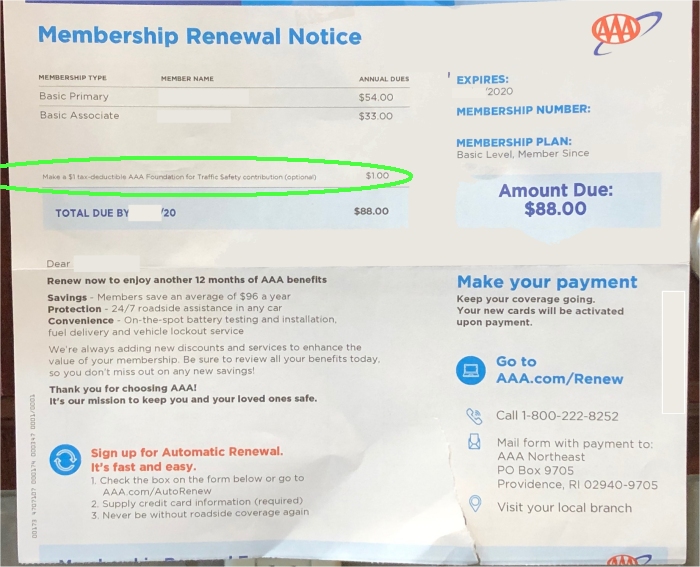

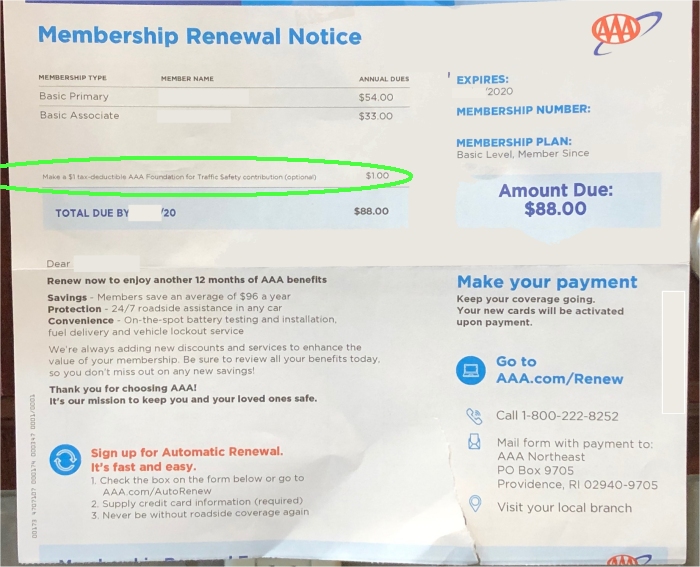

A New York reader wrote to us recently complaining about a sneaky “optional” charge that was tacked onto his annual AAA bill that he received in the mail. We then found a Massachusetts consumer with a similar problem (her bill is below):

Click to enlarge

Click to enlarge

*MOUSE PRINT:

AAA added a $1 voluntary donation to their traffic safety foundation on this bill, and automatically included it in the “amount due” rather than as a separate box to check if the member wanted to donate. On this bill, the annual membership fee due should have been $87 and not $88.

The problem with this type of billing is this: Many members may simply rip off the payment stub at the bottom of the bill and send a check or enter their credit card number for the amount the stub says is due not realizing that the actual membership fee had been bumped up by an “optional” dollar.

Payment stub from New York consumer

Payment stub from New York consumer

From a legal standpoint, this billing practice may well be classified as “cramming” — tacking a charge for a new item onto a bill without the customer’s affirmative consent and including it in the total due. As such, this may well be contrary to state consumer protection laws that ban deceptive practices.

We contacted AAA headquarters multiple times asking a series of questions about how extensive this billing practice was, whether it extended to those on autopay, how many people are affected, and whether they will change the practice. We received no response despite sending three email inquiries and calling twice.

Customers should not have to scrutinize every bill they get to make sure something they never ordered was tacked onto their invoice and included in the total. Just the way that the IRS includes a check box on your tax return so you can indicate if you want $3 to go to fund presidential elections, AAA should do the same thing if you want to add a dollar donation to their safety foundation.

There’s an old consumer maxim: it is easier to steal a dollar from a million people than steal a million dollars from one person.

We need your assistance to help determine how extensive this problem is since AAA operates as separate regional clubs around the country. Please look for your last bill from AAA to see if it includes an “optional” $1 charge or not. Either way, send a scan or clear photograph of it (crossing out your member number) to Edgar (at symbol) ConsumerWorld.org. In addition, use the comment section below to indicate what you think of AAA’s billing practice, and your experience with their bills. Please include your state, and whether you are on autopay or receive a paper bill in the mail. Thanks!

Last week, Delta quietly changed a policy so that basic economy class tickets purchased on or after December 9, 2021 would not longer earn frequent flier miles in their SkyMiles program. This big policy shift was not announced in a press release but rather via a fine print asterisked footnote on its website.

Last week, Delta quietly changed a policy so that basic economy class tickets purchased on or after December 9, 2021 would not longer earn frequent flier miles in their SkyMiles program. This big policy shift was not announced in a press release but rather via a fine print asterisked footnote on its website.

Payment stub from New York consumer

Payment stub from New York consumer For 25 years, Consumer World, the creator of Mouse Print*, has served readers with the latest consumer news, money-saving tips, and independent investigations. It is your generosity (and not advertising nor corporate contributions) that keeps Mouse Print* and Consumer World available as free consumer resources. So MrConsumer turns to you and humbly

For 25 years, Consumer World, the creator of Mouse Print*, has served readers with the latest consumer news, money-saving tips, and independent investigations. It is your generosity (and not advertising nor corporate contributions) that keeps Mouse Print* and Consumer World available as free consumer resources. So MrConsumer turns to you and humbly