We received a complaint from Phil S. saying that his Medicare advantage plan’s seemingly generous $240 annual allowance toward the purchase of over-the-counter health products was deceptive because the third-party company he was required to buy them from “grossly inflated their price” on certain items.

He’s referring to Tufts Medicare Preferred, a leading Medicare Advantage brand from Tufts Health Plan. They offer a set of plans for seniors in Massachusetts (and elsewhere) for those who want an all-in-one plan instead of having to deal with Medicare and then a separate supplemental insurer.

One of the extra benefits that some of their policies provide is a $240 annual allowance ($60/quarter) that members can spend toward eligible over-the-counter products like pain relievers, eye drops, vitamins, etc. That seems like a quite generous bonus benefit that Medicare itself does not provide.

In order to take advantage of the free OTC products, rather than allow you to go to your local CVS or Walgreens, Tufts emphasizes use of the OTC provider they have contracted with — Medline — and provides their catalog and price list online to members. Tufts is also now allowing purchases through Walmart.com, but does not provide a list of the covered products there nor a price list, and a $6.99 shipping fee on orders under $35 may scare away some members who do not go to the store for free pickup.

*MOUSE PRINT:

4 Easy Ways to Enjoy Your Benefits [three of which are Medline]

Online through Medline — Go to thpmp.org/order-OTC, log in with your OTC card number and your Tufts Health Plan member ID number, and select the items you want to purchase.

The 2023 Medline catalog for Tufts members provides hundreds of covered items. And that’s where the problem begins when comparing those member prices to what Medline normally charges on its own public website.

*MOUSE PRINT:

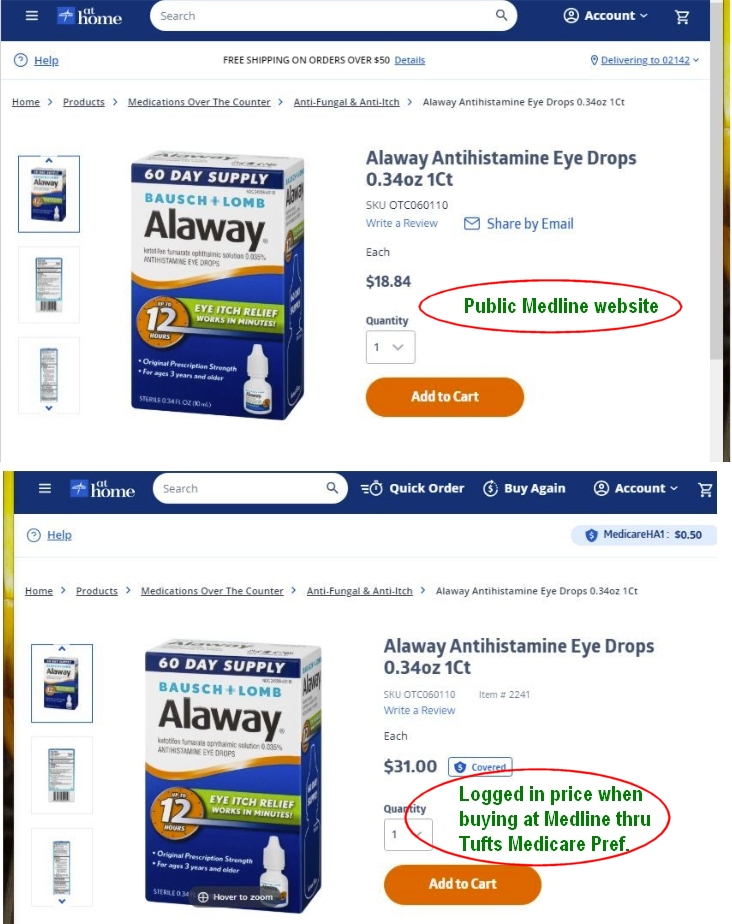

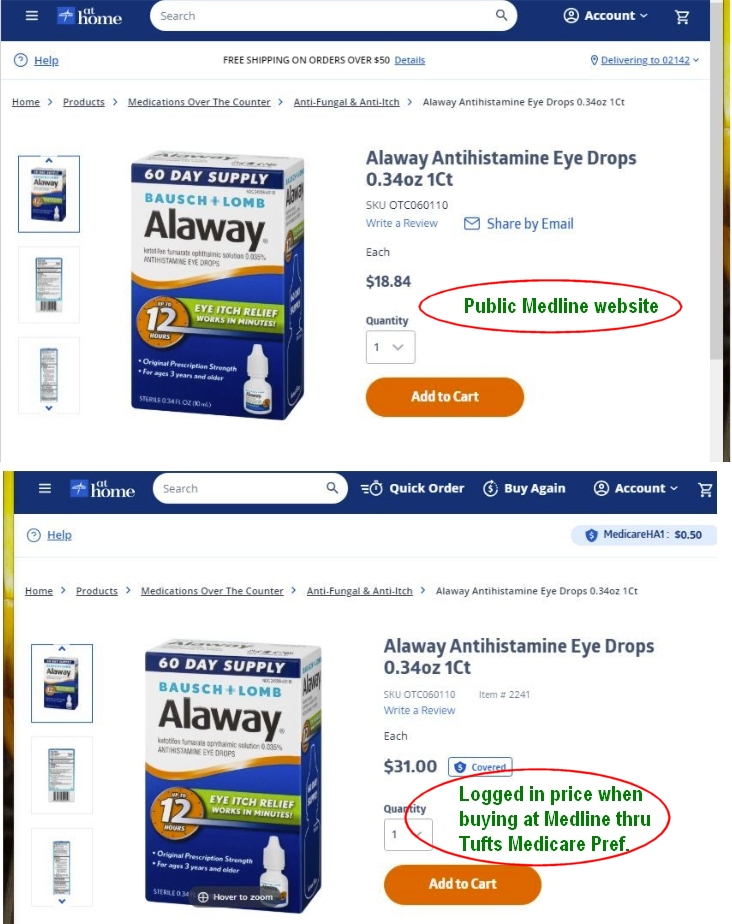

In this dramatic but atypical example provided by our consumer, these eye drops are 64-percent higher when using the Tufts benefit compared to what Medline charges on their own public website. [After we provided the insurer and Medline with this example, rather than lower the price for Tufts members, it increased the price to $31 on its public website!]

To check the price of more items, we chose 10 from the Medline/Tufts catalog of allowed products and compared them to what Medline charges for those same items on its public website. The Medline/Tufts price was higher most of the time. It should be noted that Tufts members do not directly pay extra for shipping, while the Medline public site charges a flat $7.95 for orders under $50.

*MOUSE PRINT:

Higher price noted in red

Higher price noted in red

Our consumer believes that Tufts is deceiving the public as to the actual value of the OTC benefit in that it is worth less than the promised $60 per quarter because of Medline’s inflated prices on many items. When Medline’s higher prices for Tufts’ customers are only a couple of bucks more, however, that is understandable since shipping is included in those prices but is not included on Medline’s public site.

But how do the Medline/Tufts prices compare to real world retail store prices? We compared the shipped prices of a dozen items that were available at the Medline/Tufts site and at Target.com. Target was cheaper on all but one of them.

*MOUSE PRINT:

We asked both Tufts and Medline to explain what is going on here given the expectation that pricing for a large affinity group like Tufts Medicare Preferred members should be lower than what the general public pays. We also inquired if it was fair that Medline charges Tufts members more on many items.

A spokesperson for Tufts responded to some of the issues we raised about Medline’s higher prices, and incorporated an explanation and comment they received from Medline, saying in part:

We aim for Tufts Medicare Preferred members to receive the most favorable pricing possible when using their OTC benefit. While we find it unfortunate that there are small discrepancies in the pricing on Medline’s website from time to time, pricing for our members is set six months before the benefit year and based on available market data. Tufts Medicare Preferred pricing includes direct shipping and access to live customer support for all phone or online orders.

Medline strives to provide fair and reasonable prices for all products offered to health plan members.

It seems to us that Tufts Health Plan has not done the best they can on behalf of their members:

1. They do not solicit competitive bids for the company(s) to manage their OTC program. If they did, they could encourage bidders to compete on the prices they will charge for the OTC products offered to their thousands of members.

2. The OTC program materials online fail to clearly outline the Walmart.com option and fail to list the covered products/prices as they do with Medline. Tufts says such a list does not exist and your order will simply be rejected by Walmart if you guess wrong and an item you choose is not covered. How crazy is that? At a minimum, they could have at least provided members with a direct link to the virtually hidden special Walmart Medicare OTC Network website where a curated list of products is shown, but they didn’t.

It is our hope that this story will prompt Tufts Health Plan to take a critical look at their OTC program with an eye toward making it a better value for their members and easier to use. And there is a ray of hope in that regard in one of the final comments that Tufts sent us:

We are currently evaluating our options for future benefit years, which could include additional or different online retailer options, price matching as well as the ability to purchase from retail locations.

Higher price noted in red

Higher price noted in red