Staples was a pioneer in making rebates easier for shoppers by allowing most rebates to be filed online, without the need for cutting out UPCs or mailing receipts. Rebates came more quickly, usually as a postcard-check.

When shopping for a cordless phone recently, MrConsumer was attracted to the net price, after an Easy Rebate was factored in. Upon leaving the store, and scanning the provided rebate form (for those who prefer to mail in their rebates), it became clear the rebate was a not a cash rebate (by check), but rather would be paid via a prepaid Visa card. I questioned myself about how I could have missed that in their weekly advertisement.

Upon closer scrutiny, there was no such disclosure associated with the cordless telephone:

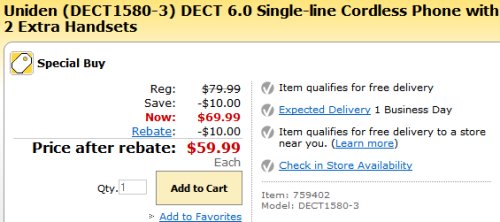

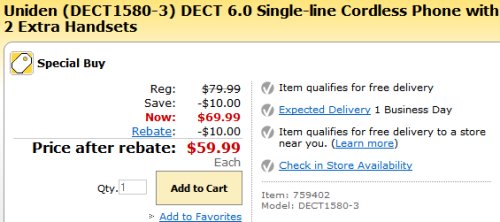

Even looking online, the item is promoted with a $10 “rebate” on the page where you add it to your basket, and no mention that the rebate is via a prepaid Visa card is made right there.

Back in the circular, an unasterisked fine print footnote where details of financing terms and copyright information is usually disclosed noted this:

*MOUSE PRINT:

“Easy rebates are now even easler. Most easy rebates will be delivered in the form of a Visa prepaid card, which can be used everywhere Visa debit cards are accepted. Visa prepaid cards will be mailed within 4-6 weeks after receipt of validated claim. The Visa prepaid card is not redeemable for cash and may not be used for cash withdrawal at any cash-dispensing location. … Subject to applicable law, a monthly maintenance fee of $3 (USD) applies, but is waived for the first six months after the card is issued.”

Besides the obnoxious monthly fee, Visa debit cards are difficult to use up in their entirety. You can’t swipe them at self-service gas station pumps yourself. Elsewhere, you have to press “credit” instead of “debit”, even though “debit” is clearly marked on the face of the card.

Worse, when you are trying to use up the remaining money on the card, you have to do an oddly structured split tender, if the item you are buying costs more than the remaining balance on the card. (A “split tender” is where you use two forms of payment in one transaction.) Visa debit cards need to be tendered first in a split tender transaction, and the cashier must deduct only the exact amount remaining on the card, which may not even be known. One penny more, and the card is rejected. Split tenders using a Visa debit card cannot be done at some self-service checkouts (which can otherwise handle split tenders very easily). Even when a real live human cashier is present, he or she may have difficulty because not all cash register systems can handle them properly.

In addition, there are other inconveniences: you have to forego rewards and other benefits that you would otherwise be entitled to when using your regular credit card, you cannot track the purchases put on the card for tax purposes using programs like Quicken, you wind up with a wallet filled with plastic rebate cards with unknown balances on them, and you cannot get cash for the balance on the card through an ATM or any other method.

Some people simply refuse to do rebates when a prepaid card is involved for these very reasons, so to have a Visa card rebate sprung on the customer without disclosure at the point the item is advertised, is dirty pool.

When asked to comment on why Staples is using Visa cards for rebates, whether they were aware of the problems they can cause customers, and whether they would change their advertising to clearly disclose the fact that the rebate was in the form of a Visa card, the company responded [portions edited]:

[We] conducted a thorough pilot to gauge customer satisfaction – always our number one concern. The results of the pilot were very favorable. In a post-pilot survey, customers noted convenience, ability to immediately spend the rebate,and elimination of check cashing fees as the main reasons they were satisfied with the switch. In addition, by offering a prepaid card, we were able to extend the rebate redemption period to six months from three months with checks. Based on customers’ positive feedback from the pilot, we began using Visa prepaid cards in June 2008. Since that time, the program has been well received by customers.

In the survey, a vast majority of customers indicated that they had no concern about being able to use their rebate funds. We provide a number of ways that customers can easily access their card balances to help make split tenders easier, including a toll-free phone number on the back of the card and via text message whenthis option is selected online.

Since the pre-paid card program launched in June 2008, we have communicated the use of Visa cards in our rebate program in multiple marketing vehicles to our customers, including in circulars, online and in-store signage. We believe we have done so in an effective way. Nonetheless, we are constantly reviewing the effectiveness of our marketing/advertising materials to make sure that our customers remain informed of all important program terms.

For one, this Staples shopper and consumer advocate is not swayed in the least by Staples’ PR spin, and is dismayed that the company refused to more clearly disclose that its rebates were now being made via prepaid Visa cards. In essence, you are getting a merchandise credit instead of the advertised cash back.