Staples was a pioneer in making rebates easier for shoppers by allowing most rebates to be filed online, without the need for cutting out UPCs or mailing receipts. Rebates came more quickly, usually as a postcard-check.

When shopping for a cordless phone recently, MrConsumer was attracted to the net price, after an Easy Rebate was factored in. Upon leaving the store, and scanning the provided rebate form (for those who prefer to mail in their rebates), it became clear the rebate was a not a cash rebate (by check), but rather would be paid via a prepaid Visa card. I questioned myself about how I could have missed that in their weekly advertisement.

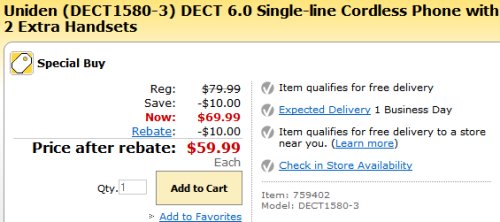

Upon closer scrutiny, there was no such disclosure associated with the cordless telephone:

Even looking online, the item is promoted with a $10 “rebate” on the page where you add it to your basket, and no mention that the rebate is via a prepaid Visa card is made right there.

Back in the circular, an unasterisked fine print footnote where details of financing terms and copyright information is usually disclosed noted this:

*MOUSE PRINT:

“Easy rebates are now even easler. Most easy rebates will be delivered in the form of a Visa prepaid card, which can be used everywhere Visa debit cards are accepted. Visa prepaid cards will be mailed within 4-6 weeks after receipt of validated claim. The Visa prepaid card is not redeemable for cash and may not be used for cash withdrawal at any cash-dispensing location. … Subject to applicable law, a monthly maintenance fee of $3 (USD) applies, but is waived for the first six months after the card is issued.”

Besides the obnoxious monthly fee, Visa debit cards are difficult to use up in their entirety. You can’t swipe them at self-service gas station pumps yourself. Elsewhere, you have to press “credit” instead of “debit”, even though “debit” is clearly marked on the face of the card.

Worse, when you are trying to use up the remaining money on the card, you have to do an oddly structured split tender, if the item you are buying costs more than the remaining balance on the card. (A “split tender” is where you use two forms of payment in one transaction.) Visa debit cards need to be tendered first in a split tender transaction, and the cashier must deduct only the exact amount remaining on the card, which may not even be known. One penny more, and the card is rejected. Split tenders using a Visa debit card cannot be done at some self-service checkouts (which can otherwise handle split tenders very easily). Even when a real live human cashier is present, he or she may have difficulty because not all cash register systems can handle them properly.

In addition, there are other inconveniences: you have to forego rewards and other benefits that you would otherwise be entitled to when using your regular credit card, you cannot track the purchases put on the card for tax purposes using programs like Quicken, you wind up with a wallet filled with plastic rebate cards with unknown balances on them, and you cannot get cash for the balance on the card through an ATM or any other method.

Some people simply refuse to do rebates when a prepaid card is involved for these very reasons, so to have a Visa card rebate sprung on the customer without disclosure at the point the item is advertised, is dirty pool.

When asked to comment on why Staples is using Visa cards for rebates, whether they were aware of the problems they can cause customers, and whether they would change their advertising to clearly disclose the fact that the rebate was in the form of a Visa card, the company responded [portions edited]:

[We] conducted a thorough pilot to gauge customer satisfaction – always our number one concern. The results of the pilot were very favorable. In a post-pilot survey, customers noted convenience, ability to immediately spend the rebate,and elimination of check cashing fees as the main reasons they were satisfied with the switch. In addition, by offering a prepaid card, we were able to extend the rebate redemption period to six months from three months with checks. Based on customers’ positive feedback from the pilot, we began using Visa prepaid cards in June 2008. Since that time, the program has been well received by customers.

In the survey, a vast majority of customers indicated that they had no concern about being able to use their rebate funds. We provide a number of ways that customers can easily access their card balances to help make split tenders easier, including a toll-free phone number on the back of the card and via text message whenthis option is selected online.

Since the pre-paid card program launched in June 2008, we have communicated the use of Visa cards in our rebate program in multiple marketing vehicles to our customers, including in circulars, online and in-store signage. We believe we have done so in an effective way. Nonetheless, we are constantly reviewing the effectiveness of our marketing/advertising materials to make sure that our customers remain informed of all important program terms.

For one, this Staples shopper and consumer advocate is not swayed in the least by Staples’ PR spin, and is dismayed that the company refused to more clearly disclose that its rebates were now being made via prepaid Visa cards. In essence, you are getting a merchandise credit instead of the advertised cash back.

I received a 30 and a 40 dollar card as part of a rebate. Went to store where 72 dollars was spent.I gave the two cards to cashier. One was accepted and the other was rejected. I called and they said I would have to wait 7-10 days since a hold was put on the 40 dollar card. I will never never never use staples easy rebates again.

As this latest retailer ruse becomes more popular (read: one lowlife company tried it, so others jumped in as a new way to screw the customer) I am becoming more and more disgusted by it. I would LOVE to see ONE “customer” Staples claimed to have surveyed or tested this on. ANOTHER retail game. I have had a $60 card sitting in my wallet for 2 months now, as I have not found a place to properly use it. Either the item I am purchasing is more than $60, or I am giving up credit card rewards. It makes me sick when these retailers try and justify these scams, and even more so when they try and tell you “customers are our number 1 priority” Please. STOCKHOLDERS are their SOLE priority. And they wonder why people dance in the aisles when they go under

Alltel also uses credit card rebates. It has gotten to the point where as soon as I get them, I go put them on our bill.

Shop at Office Max, they know how to accept those cards. Plus they offer lower prices anyway instantly, no rebates. If you do use your card elswhere. you need to tell them there is only so much money on there,split tender it and use another form of tender for the balance.

Whenever I get a prepaid Visa card, I immediately buy myself a gift certificate for the full amount at Amazon, then redeem the certificate into an account credit. This can sit there for up to a year with no fee. I’m buying something at Amazon every month or so, so it goes pretty quickly.

I use prepaid cards (and gift checks) to refill cards at Peet’s and Starbucks. I’ve never had a problem redeeming them in this fashion.

Meanwhile, with all these prepaid cards out there, the bank card companies are raking in even more transaction fees; the retailers we use the cards at are stuck paying a percentage of the sale every time it’s swiped, something that doesn’t happen with cash.

I can’t help wondering if Staples and other companies pushing this cards are getting a cut of those fees.

Personally, I have quit buying items whose base price (before rebates) is too high. Whether in check form or by debit card, they are all a hassle to have to wait for (while they are making money off your money) and as stated here, to use easily.

When I receive these pre-paid Visa cards, I simply go to the grocery store (or another store you frequent) and buy a store gift card. Then splitting tenders with store gift cards is easy as pie.

Edgar’s sure right. Besides all the other downsides, they’re terribly inconvenient to use as others below have cited. I have another good example. Let’s say your card is worth $20, and you want to use it at a gas station. You figure your tank will take all $20, so you authorize the whole card. But alas, it only takes $15. Do you think your card’s balance will immediately become $15? Nope! You’ve got to wait a week to ten days for the $5 balance to show up and be usable. Wonderful, huh?

Dan Kap,

Whittier, CA

To Dan Kap – I work at a convenience store so I know this works…

Using your example: Go INSIDE the store and prepay for $20 in gas. If you only pump $15 the cashier will just give you back the $5 in cash. Be warned though, you need to use the majority of the card or we will just credit the unused amount back. But for a small amount I would think most stores wouldn’t have a problem giving a cash refund.

If you still think these are hassles, then donate the cards full amount to your local low income assistance offices. Get a receipt and you can write it off on your takes. The offices then can either use them for their petty cash fund for office expenses. Or you could stipulate that it should be given to a low income family who wouldn’t mind a the ‘hassle’ of receiving an extra $20 for groceries.

@Scott,

That is a wonderful idea!

I would go buy a gift card, personally, which seems to solve the whole problem.

I must be the only one that loves these cards. I think that rebate checks are bothersome because I need to go out of my way to go to the bank, wait in line. Usually the check just sits in my car waiting for days, sometimes weeks. With the visa card, I just use it to buy my groceries or whatever. It has never been a issue, even at Walmart to tell the cashier that I need to put 123.45 or whatever on the Visa card and the remainder on something else. Also I do not find it hard to keep up with the amount on the card either, it is just simple math. Part of basic personal finance is knowing how much money you have in your accounts at all times.

Staples rebates have been a problem for years as I found out after I tried to

get a rebate on a printer several years ago. Staples rejected my rebate

request, claiming I hadn’t submitted all the required paperwork. I don’t

remember all the details but I do remember that it was impossible for me to

provide the “missing” paperwork. Luckily it was within 30 days of the purchase

and I hadn’t opened the printer so I returned it, got a full refund and

stopped shopping in Staples.

I LOVE THESE CARDS!

With direct deposit…I never go to the bank. So, cashing a rebate check is such a PAIN. With rebate cards…I can immediately apply them to a bill since I pay them all online. And I always have a bill that is greater than the amount of the rebate card. There is no problem tracking this money in Quicken, either. I use a CASH account…and it works fine. Rebate debit cards are quick and easy!!!

FYE (music and movies chain) is now also issuing Visa debit cards for rebates over $20. (I know this because I’m sending in 4[!] rebates to them today.)

For those who sell on eBay, I use these debit cards to pay off part of my fees.

Others have suggested on a forum that I visit that one can buy Amazon gift certificates with them and then use them yourself.

Otherwise, they’re a PITA to use anywhere else.

I received a $30 Visa rebate card from Staples. Tonight I made an on-line purchase for $29.99. Guess my balance is now one penny.

So, in six months will I start getting a $3 monthly service fee charged? I really do not like these cards and will avoid purchases from Staples (rebate or not) in the future.

Visa debit cards are as close as you can get to real life spyware. Think about those debit cards as a way to track your spending habits. I would suspect that additional data on those users are culled from the supermarket cards used for discount.

The sad truth is that it is more about information gathering than the inconvenience of carrying extra plastic in your wallet or a split transaction. It is about your psycho demographics. For some it isn’t an issue. Others feel threatened by corporations that have access to what they buy. For the uninitiated the point is that from those bits of data about you a personality profile is extrapolated. The purpose to to find more ways to make future purchases appeal more emotionally appealing.

In a free market those companies should pay for the information obtained about our buying habits. I feel the same about those research companies who ask for a few minutes of your time. The other day a researcher called to ask if I would participate in a market research study. I told him that I’d be happy to, but first I wanted to know how much I was going to be paid. There was a long pause before the researcher said, “There’s no payment involved. It’s just a series of questions about your opinions.”

I said, “Let me get this straight. A company hired your firm to do research for them and you are being paid by your firm to gather that data. Obviously, someone is willing to spend money for the information you’re gathering.” “That’s correct,” replied the researcher.

“It seems that everyone is being paid to obtain the information but the people who are supplying it. I want to be part of the food chain. When you’re willing to pay for the information I provide, then I’d be happy to participate.”

Consumers need to understand that the information they supply to companies like Staples, when using those debit rebate cards, is valuable information and should be compensated. At the very least people applying for a rebate should be given a choice between receiving a check or debit card.

To Dan Kapp — RE: using debit/credit cards at filling stations.

A few months ago I helped a friend move her household belongings long distance. As anyone would guess those U-Haul trucks get low gas mileage and need refueling fairly often. After several refuelings she found her card denied.

A call to the credit company revealed that if you use a card at the pump the station puts a hold on dollar amount well above the expected fuel charge. That way they know you are good for what you are about to buy. As Dan discovered when a credit amount is charged against a card, but that full amount isn’t used, it takes approximately a week for the difference to re-appear on the balance.

Fortunately, the credit card representative was able to clear the charges immediately. She then dispensed this bit of advice, “If you use your card inside the station then the charges against your card will be only for the amount of the final sale. Using your card at a pump will always put a hold of a $100 or more on your card and you’ll have to wait for a week or so for it to clear.”

Staples study? LMAO! No…make that LMFAO! Here it is for Sraples – you lied. NFW you did any study. That was just a side step to avoid answering the real question – your use of mouse print and the fact you can weasel out of some of this with the “cards.”

I too hate the way Staples are giving rebates. I recently received a $30 rebate card that was rejected at Wal Mart check out. Since my Staples store was close to Wal Mart, I had to go there to wait in line to discuss this problem. They explained how to use them. I had to wait for another transaction somewhere that was more than the rebate, then do the “split tender” method to pay. I liked the old way of a postcard check much better, and wish I could now participate in their survey. They would get an earfull.

Why do people put up with rebates at all? If any company tried that in my country they’d be laughed out of town by their competitors, who would simply match their after-rebate price and then savage them with adverts criticizing the hassle they were putting customers through.

You are all so lucky..at least you rec’d a rebate in some form. I did a rebate online to Staples last Dec.10, one day after my purchase. Feb. 13, this year I e-mailed a rebate inquiry. Unable to locate..must have gotten lost in cyber space!! I was told to mail my rebate so I sent it to Florida on Feb.14. On April 31 I called and talked to a man who checked and told me they have no info on that submission either! He said to do it online again cause that would be faster. I did that and the message came up that my Rebate Offer Number is no longer valid for online submission. So they have cheated me out of $51.00 !!! Apparently I can’t contact them to complain anymore. Luckily, I have several other stores close to home…I’ll shop there from now on.

Just like som eother people said, it’s a trade-off in convenience between having to physically deposit a check (for those of us who don’t often frequent a brick-and-morter bank) and having to deal with small left-over amounts on the card.

When I have that situation, I use the card to partially pay my cell phone bill online. Sprint happily allows partial payments of any amount.

To the person who had a 1 cent remaining balance: the $3 charge stops when the value of the card reaches zero. So in month 7, 1 cent would be deducted (instead of $3), and the card would then be defunct.

Some of the malls (Alderwood Mall is the one I went to)here in the Seattle area do this w/their gift cards. and you MUST know the exact amount left on it to use it. You can find out by accessing a machine that is available, but you have to find that. It is such a pain in the $^%^$^%$ that I gave the gift card away. Also the clerks in the stores are REALLY rude when you use the cardc.

I received my $50 rebate card in the mail. So strapped for cash I decided to use it and go out to dinner with my family. Darned card was declined. I was soooooo embarressed. Lucky for me my Dad was with me or I would have been doing the dishes.

I believe it is a very sneaky way to get unsuspecting shoppers in the store and purchase their products. I had an experience about 1-2 months ago where a label maker was advertised on the front page of the flyer for $19.99 and was FREE after rebate. Well, I’m no fool…free means free, right? Not when it’s Staples! There was no asterik, no fine print…just ‘free after rebate’. As a matter of fact the rebate was for $20, so if all went well, I would have made money (1 cent) on the deal!

Well, I submit the rebate receipt information online and then read the terms and conditions on the actual register receipt. It states that the ‘rebate’ is a Visa pre-paid card. I was livid. This is not the same as the product being FREE!! I called up customer service and told them I needed the rebate request cancelled because I was returning the product back to the store and I did just that! That was just plain ‘ol sneaky! Nice job Staples.

I find Staples to have the easiest rebate process in the world. You buy your free after rebate items. You submit your rebate online the same day. About 4-6 weeks later a prepaid rebate card shows up. I use it within a week to fill my tank (hint: go inside and tell them the exact amount), or to pay my utility, phone, or cable bill. It’s so easy. Nothing to mail, no pen needed, no trip to the bank to deposit the check. The rebate card always shows up within the stated time frame. I hope they never change their rebate program. I’ve never had a rebate card declined either, and I do their rebates each and every month. It’s a great way to get things for the price of tax, whether I’m donating them or keeping them.

Funny, I’ve never received a card for a Staples rebate before. I guess my rebates were too small to put on a card.

However, my complaint is that the rebate checks they send out are in the form of POST CARDS! The fact that it’s a check and the amount it’s for is exposed for everyone to see who handles the card. Good thing that I have a box at a UPS store, and not a mailbox outside my house.

redeem all credits right at the store. i got a mess of paper receipts and total confusion. please please please get new software and make it simple to get all rewards w/o so much hassle.get some of those nerds busy and remind them of the KISS principle…

I had a Staples Rebate card and, after trying to use it at two large retailers unsuccessfully, gave up. When I purchased something at Staples and tried to use the card, I was told it had expired 5 weeks earlier – there was an expiration date on the card that I didn’t see. I called the number on the back of the card and the rep said she would send me out a check. I didn’t expect it to be so easy. Thanks Staples for the good service

I get the rebate cards all the time and I just had one expire, I called the number on the back of the card, they verified my information and reissued a new card, no problem. I have never had a problem at the terminal with their cards.

I’ve never had a problem with rebate cards. I don’t know about you, but I keep my receipts for the purchases I make with a rebate card in order to have the correct balance. I know it may sounds neurotic, but it does keep me from experiencing the frustrations of not knowing how much is left on a card. Usually, I find a great use for rebate cards: groceries. Most places will let you do split tender and its better to put that rebate money towards food than a video game or a new pair of shoes. Just saying.

We received a Staples rebate card for $60. I used almost $30 in one place, no problem then tried to use it as a split at the grocery store on an almost $90 charge, and the entire thing got paid! I know I’m on the opposite end of the spectrum here, but ?? That’s not what is supposed to happen. Tried to call Staples to find out why it went thru, and they wouldn’t talk to me w/out giving them personal info. Er, no, not going to happen. How can more money than is left on the card go thru on a prepaid card? And what happens now? Has anyone else encountered this?