For the past three years, consumer groups including Consumer World have called on big supermarket chains to make digital coupons easier to use for seniors, poor folks, and others who either don’t use the internet or smartphones or who are not particularly tech-savvy.

Normally, a shopper has to use the supermarket’s website or app to individually select and load each digital-only offer or coupon onto their store loyalty card account before they shop in order to get the advertised discount.

Consumer World photo illustration

Consumer World photo illustration

Now Kroger and some of its various supermarket brands like King Soopers have come up with a simple and cheap solution. They are making available digital deal savings sheets — a “super coupon,” if you will — that is a two-sided piece of paper that you pick up as you enter the store or at the courtesy desk. All that week’s advertised digital deals from the store’s current circular are summarized there, and a small barcode is provided on the back. The shopper need only scan that barcode at the checkout, and then all that week’s advertised digital coupons will be loaded onto the customer’s account and the savings automatically deducted from their bill.

*MOUSE PRINT:

Sample Kroger Digital “Super Coupon” (click to enlarge)

Sample Kroger Digital “Super Coupon” (click to enlarge)

Consumer World asked the company for details about which of their chains have implemented these deal sheets, but they did not respond to multiple requests. Nonetheless, we salute Kroger for finally heeding the call to make digital coupons easier to use and available to digitally-disconnected shoppers.

We also asked The Consumerman, Herb Weisbaum, to check the stores in the Seattle area — QFC and Fred Meyer. He reports that both stores had displays of the “super coupons” near the store entrance.

If you shop at a Kroger-owned store (Kroger, Baker’s, Dillons, Food4Less, Fred Meyer, Fry’s, Harris Teeter, King Soopers, Mariano’s, Payless, Pick’n Save, QFC, Ralph’s, or Smith’s), please post a comment noting whether your store now has the “super coupon,” and if it was near the store entrance or if you had to request it. (Some locations reportedly are keeping them hidden behind the service desk, believe it or not.)

Kroger’s move follows an initiative by Stop & Shop at the beginning of 2025 to install “Savings Center” kiosks in the front of their 350+ stores where all a shopper need do is scan her loyalty card and then all that week’s advertised digital coupons are automated loaded onto her account.

Some of these efforts by supermarket chains to make digital coupons easier to use are the result of consumer complaints by customers, the advocates’ campaign to end digital discrimination, and legislative efforts requiring that non-digital alternatives be offered.

In regard to legal initiatives, San Diego’s new ordinance that requires supermarkets to make available printed versions of digital coupons in the store just hit a road block because retailers are opposed it. They lobbied for an amendment that would completely gut the new requirement. See Coupons in the News. It is scheduled for a new hearing this week. Stay tuned.

=======

UPDATE

=======

Without going into great detail here, MrConsumer wrote to the entire San Diego city council pointing out the issue with their proposed amendment. And they listened and voted approval of a revised amendment. Now stores need provide “an in-store alternative” for all publicly available digital-only deals and digital coupons (instead of the only option being printed versions of digital coupons). They dropped the explicit exclusion of digital offers in store loyalty programs that would have been fatal to the original amendment. The new ordinance gets a second reading soon, and goes into effect in October.

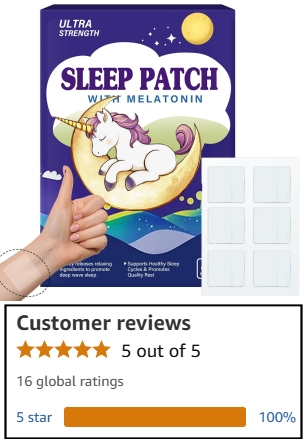

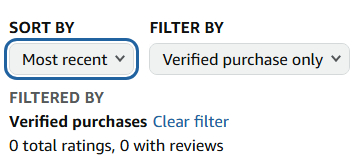

As the leading online seller, Amazon certainly can be a target for fake reviews. A friend who was looking for remedies to help him sleep better, scoured Amazon looking for possible solutions. About six months ago, he came upon this product called

As the leading online seller, Amazon certainly can be a target for fake reviews. A friend who was looking for remedies to help him sleep better, scoured Amazon looking for possible solutions. About six months ago, he came upon this product called

Consumer World photo illustration

Consumer World photo illustration